Automate and streamline approvals with ease

Consolidate and see all your bills in a central place. Upload or email invoices to one platform that helps protect against fraud with real-time alerts on invoice tampering and duplicates.

An accounts payable solution that suits your business needs

Create multi-layered approval workflows

Our intuitive interface allows you to assign approvals to different teams and individuals with ease.

OCR data capture and line-item extraction

Reduce manual data entry with in-built Optical Character Recognition (OCR) technology.

Pull bills and push payments to your accounting software

Simplify the complexity of reconciling local and international payments by integrating with your accounting software.

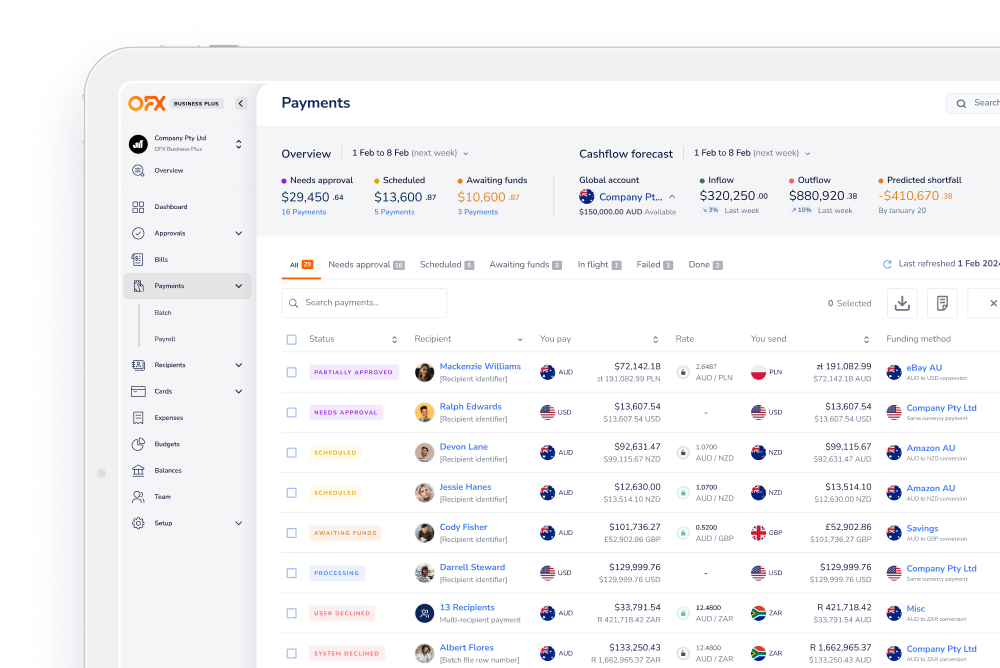

One platform to facilitate all your accounts payable needs

No more switching between different apps. See every bill, approval, currency and payment all in one place.

Ready to get started? Create your free account now.

Less human error

Our AP automation system automatically reads every bill, BPAY number, BSB and any country’s bank account details, reducing human error from manual data entry and checking.

Schedule the payment date, and circulate for approval all within one platform. Get more time back as you no longer have to share Australian Banking Association (ABA) files over email.

Tailored approval workflows to suit your policies

When you build an approval policy in the platform, you can customise the triggers to suit your own internal policies- who’s involved, when they’re involved, and for the type of spend.

Fast-track your data sync with your accounting software

Automatically reconcile your expenses by integrating with your accounting software.

If you use Xero accounting, your entire payment lifecycle is kept in real-time sync with Xero, so you’ll never have duplicate bill and payment processing work.

The power of smart Accounts Payable automation and workflows

Automate your invoice data capture, set up custom approval workflows, pay and reconcile with your accounting software in real-time.

- Save time

Regain valuable time with our AI technology to help automate your invoice data capture. Our system can extract an invoice due date, bank account details, and currency, plus automatically check ABN and GST registrations. - Greater control

Set company policies and bespoke approval workflows. Define what requires approval, who can approve, and which team members have visibility. - Enhanced flexibility

Choose to pay in a way that suits your business needs. Pay an entire bill, part of a bill or multiple bills. Automatically combine payments to minimise your costs, and keep everything in your accounting books updated as you go. Sync with Xero for real-time automatic reconciliation.

FAQs

What are the benefits of using AP automation for me and my business?

By using our software, you and your team can transform finance operations from a chore into a strategic asset. Our integrated platform not only automates your accounts payable, bill capture, and approvals, it also handles multi-currency transactions.

This means not only does every invoice get captured and every payment processed with precision, but you also gain visibility into your financial workflows. It helps you make informed decisions faster, leveraging real-time insights that could potentially save your business money.

Instead of wrestling with tedious data entry or juggling multiple tools for different tasks, we help you with a single, smart solution that helps safeguard against errors and fraud.

Can AP automation capture invoices and checks automatically?

Yes, it can. The built-in AI technology (OCR) in our AP automation software enables you to digitally capture your invoices. It also automatically routes invoices for approval without paper forms, helping you to gain visibility over the approval process and promptly address any bottlenecks.

Can it also analyse receipts?

Yes, it can. Expense receipts can either be uploaded to support a card transaction or as a reimbursable expense claim.

Can I have an approver for the invoice and bill, and have a separate approver for my payment?

Yes, you can set up separate approval policies for bills, expenses and payments. We also know that there can be different layers of approvals. That’s why we built a multi-tiered conditional approvals system, where you can set up rules and edit them within the platform.

How can I get access to the OFX AP automation solution?

The OFX Business Plus plan gives you access to our AP automation and approvals workflow solutions, plus more. The cost per user is AU$15 per month after your 30 day free trial. This includes the full benefit of the platform. See our pricing plan here.

Can it be integrated with Xero?

Yes. You can connect our AP automation solutions to Xero through the OFX Business Plus plan, by following the below steps.

- Log in to your OFX Business Account

- Click on “Setup” from the left sidebar menu.

- Click on “Integrations” from the dropdown menu.

- Click toggle to connect to Xero.

- Read the acknowledgment and confirm.

- Follow the on-screen instructions to authorise the integration with Xero.

Is it compatible with other accounting or Enterprise Resource Planning (ERP) platforms?

Yes. You can export data from your OFX Business Account as a CSV file and import it into your accounting platform.

We’re working on integrating other accounting packages with our platform, which will be available soon.

Want to learn more?

Gain more control and time with streamlined accounts processes – all from a single platform. Get started for free with a Business plan. Or enjoy more features in our paid Business Plus plan with a 30-day free trial.