What the FX next? Currencies in 2021

December 2020

If 2020 wasn’t difficult enough a year, potential turbulence over the next few months will mean the Christmas season will feel more like a pause than a break for financial markets.

With a European winter setting in, new waves of COVID-19 are reinstating lockdowns and restrictions. Across the pond in the US, the situation is going from bad to worse with record daily coronavirus cases and deaths. Recovery hopes hinge on how quickly vaccines are rolled out.

An American return to stable governance and re-engagement in multilateralism should give investors and currency market observers more certainty going into 2021, but there are plenty of moving pieces affecting where currencies will be in the new year according to Sebastian Schinkel, Global Treasury Manager at OFX.

The US: A new hope

America may look picture perfect in terms of the stock market, but that glossy veneer hides some shaky foundations. The country is still grappling with a strained health care system, high unemployment, a divided government and soaring debt levels.

Right now, however, the dream outcome is taking place for investors in equities; Trump’s administration has only weeks to run, and Biden is putting experienced, known entities into the cabinet, cheering investors and helping the US stock market to record highs. The Dow Jones reached the fabled 30,000 points on November 24 — the day Trump approved the transferal of power to the Biden administration.

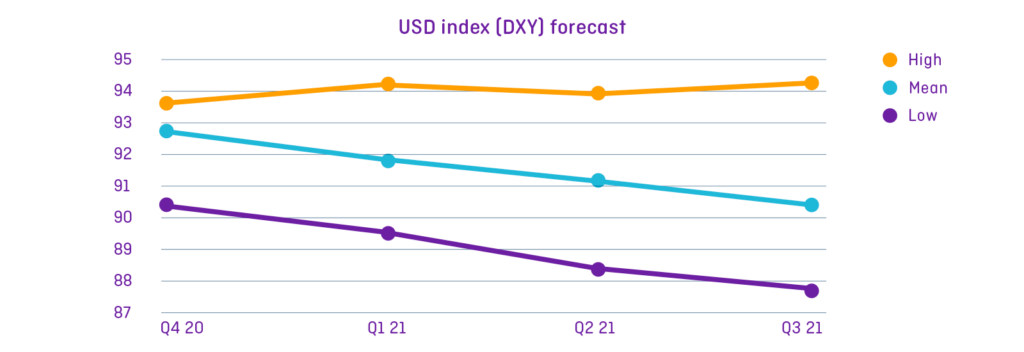

The enormous power of the US Federal Reserve’s quantitative easing (QE) has kept the dollar low relative to other currencies in the last few months, and Fed Chairman Jerome Powell has no plans to raise rates until maximum employment is reached or inflation rises about 2%. Under QE, the Fed creates money to buy government or corporate bonds, pushing down interest rates to encourage spending rather than saving. Currently the plan is to buy “at least” $US120 billion a month to support the recovery1 until a clearer picture of the economy emerges. That suggests USD weakness is likely to continue until the Fed sees the impact of any anticipated stimulus spending under the Biden administration.

Two factors are worth bearing in mind, however, Schinkel said. The US stock market is currently priced to perfection. As the vaccine gets closer, investors may finally start to look more closely at the fundamentals underpinning stock valuations and may not like what they see. Any negativity could spark a correction, rotating investors out of stocks and into safe-haven territory like US treasuries, pushing up the US dollar.

On the politics side, The Republicans retain a majority in the senate, which means that any plans the Democrats might have for increasing regulation or raising taxes are less likely to get through — a desired outcome for investors.

That’s why the Georgia Senate run-off on January 5 is for “all the marbles” as one Republican strategist described it .2 If the Democrats win, they will control both houses, and Schinkel says investors should look out for a “big drop in equities and probably some USD demand” on fears an anti-corporate agenda gets enacted.

Potential currency curveball: Republicans rediscover fiscal conservatism, choking off government stimulus.

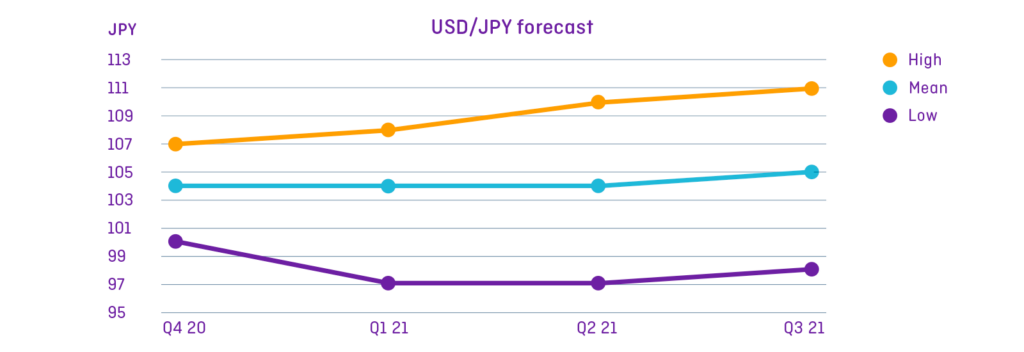

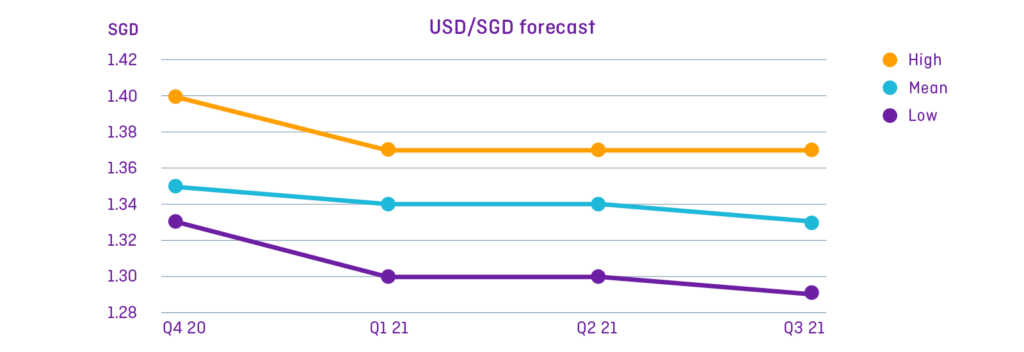

Source: Bloomberg aggregate forecast data from global bank contributors

China powers ahead, with Asia in fast pursuit

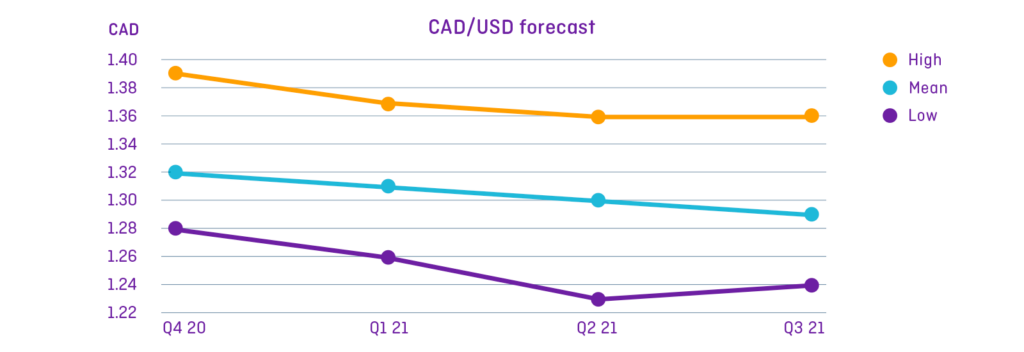

First in and fastest out of the blocks looks to be the COVID-19 recovery playbook for China and the region. China is expected to grow over 7% in 20213, having already recorded 5% growth from July to November4, rendering COVID-19 a mere blip on their economic trajectory. Big government spending is bolstering the economy against the global downturn but, unlike other markets, low interest rates won’t last forever. Investors sold off the Chinese index on November 25 after central bankers told the market it would maintain a “normal” monetary policy — read ‘not ease further’.5 While there were no plans to raise rates, the rapid growth in the economy, such as factory activity expanding at the fastest rate in three years6 means the People’s Bank of China (PBOC) has a tricky task in 2021. The yuan is already appreciating as foreign investors buy into China’s growth story and the PBOC won’t want that higher currency to choke off exports. On the other hand, it will want to ensure the economy doesn’t overheat — that means higher rates at some point and a stronger CNH.

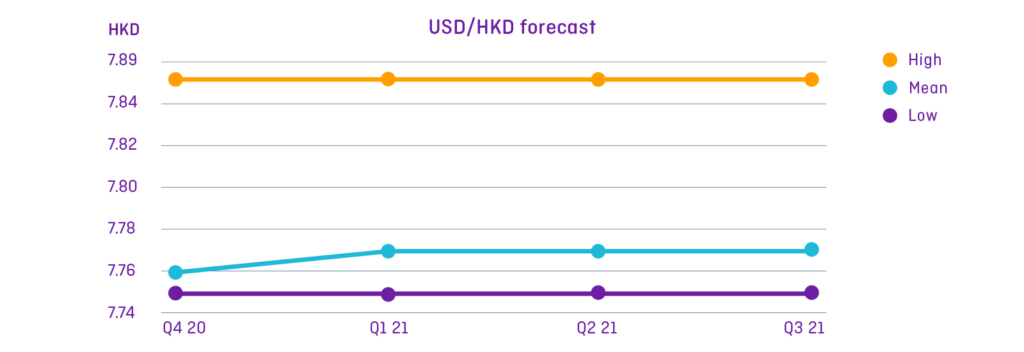

Source: Bloomberg aggregate forecast data from global bank contributors

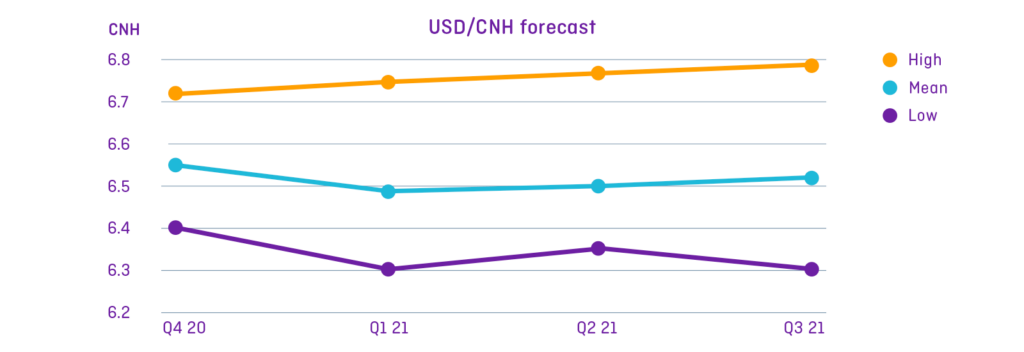

Other emerging markets in Asia are also experiencing currency appreciation as they are linked to any growing export demand that may follow the arrival of a vaccine and a global economic rebound. Singapore and South Korea are two standouts in terms of their prospects, Schinkel said, “doing interesting things and positioning themselves really well.”

Potential currency curveball: Trade war escalation spooks markets causing flight to USD, Japanese yen, Swiss franc and gold.

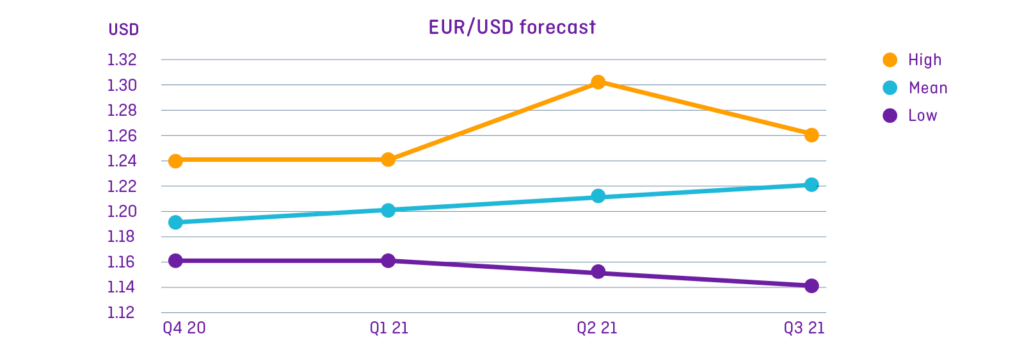

Source: Bloomberg aggregate forecast data from global bank contributors

Can Europe meet its potential?

Heading into the end of 2020, the World Health Organisation reported that Europe was leading the world in both COVID-19 cases, and related deaths.7 Fortunately, the rate of infection is declining again – a testament to the importance of restricting movement and economic activity – but it does mean that Europe faces a long winter where growth could be constrained.

The euro has been appreciating as the US dollar declines but has been stuck between US$1.16 at the lower end and $1.20 at the top since July, Schinkel said, and hasn’t been able to break higher due to COVID-19 concerns. Currently, the patchwork nature of Europe’s COVID-19 cases makes it a tricky currency to forecast but in the medium term “it’s one of the areas that has the most potential” for economic growth.

The European Commission announced in late November it had secured 160 million doses of the Moderna vaccine, so if that rollout can happen quickly, growth – and euro appreciation – may follow.

Potential currency curveball: The European Central Bank is doing all it can which means fiscal policy will need to prop up the European economy. With domestic issues consuming member states, getting consensus will be difficult.

Source: Bloomberg aggregate forecast data from global bank contributors

Britain emerges after Brexit endgame

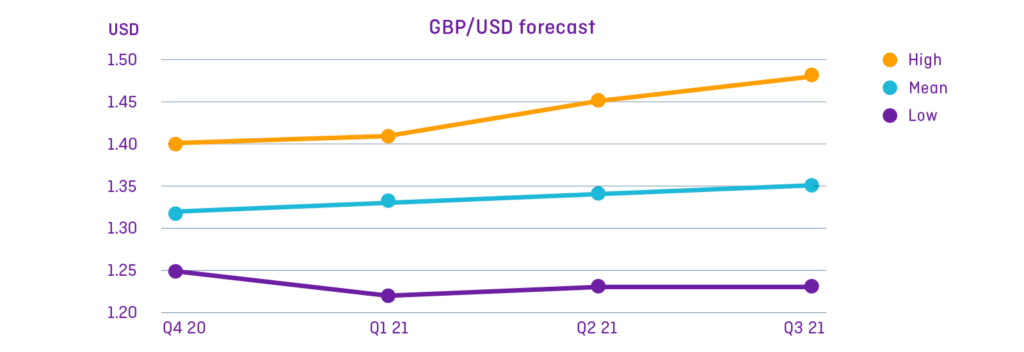

This year the UK will have its steepest economic decline in 300 years thanks to COVID-19-related shutdowns, and its debt is tipped to reach its highest level ever outside of wartime. Things don’t look much better for 2021, with unemployment tipped to rise to 7.5 per cent, and a raft of taxes expected to keep debt under control.8 More worrying is the uncertainty around Brexit. Schinkel said the pound, like the euro, has been another strong performer this year but everything hinges on whether it can strike a Brexit deal with the EU. “As soon as you get some tensions, it’s likely to drop,” he said.

Potential currency curveball: Britain surprises to the upside. “Their dynamic economy can move really quickly,” Schinkel said.

Source: Bloomberg aggregate forecast data from global bank contributors

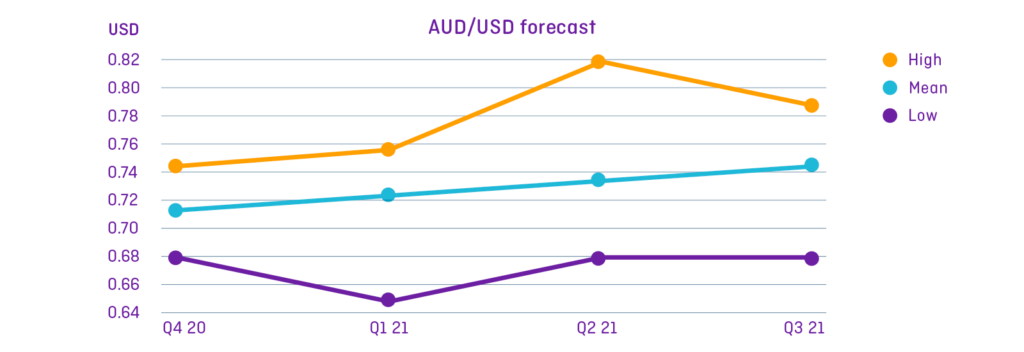

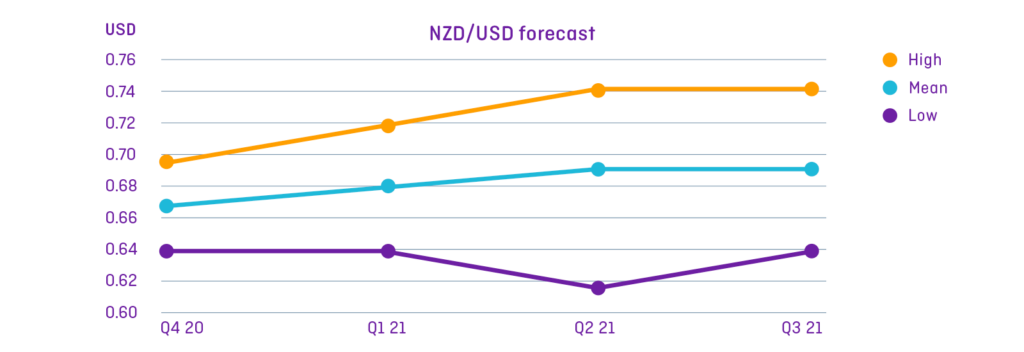

Australia and New Zealand in position for a post-vaccine world

With the virus near eliminated, the Antipodean economies have one of the best platforms for growth in the developed world. Schinkel said Australia is a “sweet spot” and primed for a post-vaccine world where students and tourism from China in particular would immediately boost the economy. In recent minutes released, The New Zealand Reserve Bank said the economy was more resilient than earlier assumed but there has been speculation that the NZRB could send rates negative in an attempt to keep its dollar competitive and supply more stimulus.9 Should rates drop below zero, the return on investment sinks, which would reduce overseas demand for New Zealand assets and prompt investors to sell off the NZD to chase better returns elsewhere.

In Australia, the Reserve Bank is playing a game of “wait and see,” Schinkel said, and has a stronger focus on reducing unemployment than trying to get the dollar down. Most forecasts, according to Schinkel, have a higher Australian dollar into the medium and long term, which “makes sense given where the US dollar is and how resilient the Australian economy is.”

Potential currency curveball 1: What happens when Australian government stimulus payments and bank mortgage holidays get wound back in March?

Potential currency curveball 2: How Australia manages its trade relationship with China.

Source: Bloomberg aggregate forecast data from global bank contributors

Preparing for the year ahead

Unfortunately currency crystal balls don’t exist and, as we saw in 2020, markets can be hard to predict. With a US handover, COVID-19 challenges and geopolitical gyrations, exchange rate shifts are never out of the question, so it makes sense to consider your global money transfer needs and goals for 2021, and to be prepared. That way, when currency swings present opportunity, or you need to act quickly to defend against rates moving against you, you will feel confident and in control. Because when it comes to your money, informed decisions are the best decisions.

Whether you’re waiting for the right exchange rate, or just need a little support with the transfer process, our OFXpert team is here to help 24/7. Contact us today.

______

1https://www.reuters.com/article/us-usa-fed/fed-keeps-policy-steady-as-biden-inches-closer-to-victory-idINKBN27L0I6

2https://www.nytimes.com/2020/11/19/us/politics/georgia-senate-races-donations.html

3https://country.eiu.com/china

4https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/covid-19-magnifies-brics-divergence-as-china-solidifies-lead-61053247

5https://www.bloomberg.com/news/articles/2020-11-25/china-stocks-retreat-the-most-in-3-weeks-on-liquidity-jitters

6https://www.reuters.com/article/us-china-economy-pmi/chinas-factory-activity-expands-at-fastest-pace-in-over-three-years-idUSKBN28A048

7https://edition.cnn.com/2020/11/25/europe/europe-coronavirus-deaths-holidays-intl/index.html

8https://www.bbc.com/news/uk-politics-55072003

9https://www.reuters.com/article/newzealand-economy-rbnz-int-idUSKBN26Z0F1

Download the OFX Currency Outlook

Learn more in the latest edition of the OFX Currency Outlook. It’s been produced to help you navigate market movements today, and to understand what to watch out for in the coming months.