What the FX: Currency markets ride the election wave

November 2020

Held during a global pandemic, with record numbers of mail-in votes and high polarisation between two parties, this year’s US election was always going to be an interesting ride. Now that the dust is starting to settle, find out what the results could mean for the US dollar and currency markets.

Joe Biden elected as the next US President

After multiple days finalising the ballot count, Joe Biden has now been called as the US president-elect. After a close-fought battle against incumbent Donald Trump, Biden secured more than the minimum 270 electoral college votes required to win.

At the time of writing, Donald Trump was yet to concede to Biden and had commenced legal action over unsubstantiated claims of widespread voter fraud1 2. However, with all media outlets calling victory for Biden and many of the world’s leaders congratulating President-elect Biden on his win3, it appears there is little credence being given to the voter fraud claims and contested result.

With broad acceptance of Biden as president-elect, financial markets do not seem worried that President Trump’s threats of legal action casting uncertainty on the outcome.

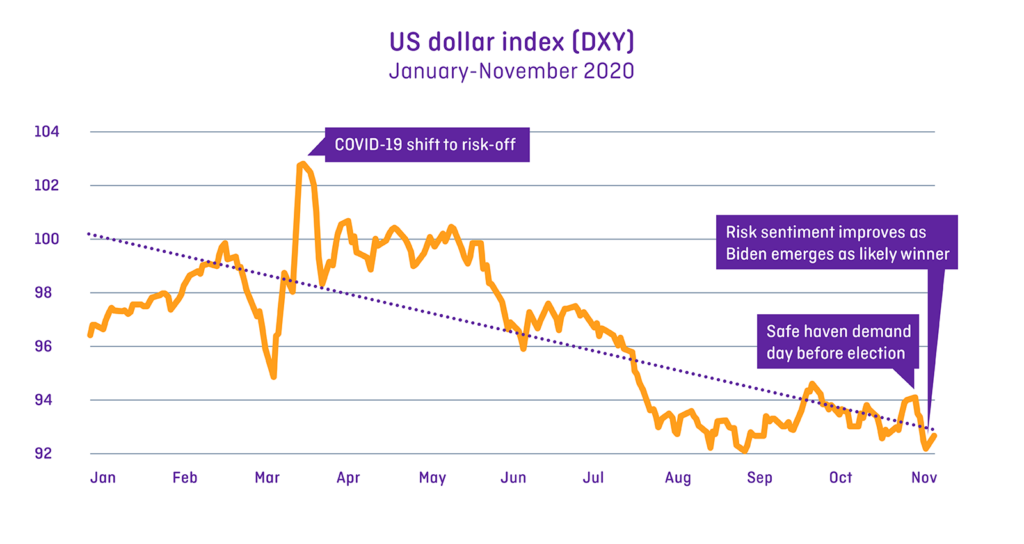

A drawn-out election process triggered currency volatility

It was a nail-biting week for both sides as the votes were counted, creating considerable volatility in currency markets during the period between the election on November 3 and the calling of Biden as winner on November 7. Ahead in the polls, Biden went into the election as favourite, but when early ballot results leaned towards Trump, the disparity to the currency market expectation triggered volatility. Sebastian Schinkel, Global Treasury Manager at OFX, said: “It was a turbulent week, but optimism of a Biden win prevailed, and with it, markets turned more speculative. Major currencies, especially the so called ‘risk’ currencies like the Australian dollar, Mexican peso and the South African rand, outperformed the US dollar.”

Mr Schinkel said that the safe haven currencies such as the Swiss franc and Japanese yen both strengthened against the US dollar as the final vote tallies were being counted. The Swiss franc reached a level not seen since 2015 as it strengthened more than 2% against the US dollar.

Global equities also performed positively, the S&P Index gained more than 7% on the week, while European equities spiked more than 8% on average. Mr Schinkel said: “This due to the stock market expectation that a Biden win with a divided congress means that higher taxes and regulation become less attainable.

Recent positive headlines around a COVID-19 vaccine trial have also helped to further buoy risk appetite as the global economy looks to be facing further fallout from the pandemic.

Caption: The US dollar has taken direction from shifting COVID-19 risk sentiment and election uncertainty this year.

COVID-19 is still an issue

Despite the current optimism around a Biden presidency and progress towards a COVID-19 vaccine, uncertainty lingers. The COVID-19 pandemic, with the US currently experiencing record numbers of daily cases, could trigger further market volatility in the coming weeks4. The uncertainty could drive commodity currencies (currencies that have the tightest correlations with commodities) such as the Australian dollar, New Zealand dollar and Canadian dollar lower as the US dollar benefits from demand as a flight-to-safety currency.

US Federal Reserve Chairman Jerome Powell has expressed concern about the recent rise in new COVID-19 cases, acknowledging that more fiscal and monetary support will be needed to aid the economic recovery. Mr Schinkel said: “Until the US can withstand the COVID-19 pandemic, the recovery is going to be uneven.”

What could President-elect Biden bring to the global economy?

Joe Biden has already made it clear that he wants to heal the division in America5, but his presidency is also set to bring lower geopolitical risk as he seeks to reduce the isolationist policies employed by President Trump. This will have a bearing on everything from Brexit to China to the Middle East. He has already pledged to re-join the World Health Organisation6 and the Paris Climate Accord7.

Although it is too early to determine exactly what improved diplomacy could look like under Biden, lower geopolitical risk should improve risk sentiment and benefit commodity currencies (AUD, NZD and CAD) and equities. The CNH (offshore Chinese currency) has already been one of the biggest winners on the back of lowered tension expectations between the US and China. In turn, this could be positive for the AUD and NZD, which both benefit from economic prosperity in China.

The Senate hangs in the balance

While the election of the president is important, equally important is the control of congress, which will determine the extent to which the new administration will be able to achieve its goals. Democrats have retained control of the House of Representatives however we will not know the outcome of the race to control the Senate until the Georgia election run offs on January 6.

The result will have the potential to create further volatility in financial markets. If there is a ‘blue wave’ with the Democrats taking control of both the Senate and House of Representatives, President-elect Biden would have ultimate power in passing the laws that will fulfil his agenda. In this scenario, we would expect to see more fiscal spending and higher inflation expectations in the medium term. This would likely cause the US dollar to fall more aggressively, said Mr Schinkel.

If the Republicans can retain control of the Senate, there is likely to be the least amount of upheaval for the US economy. In a polarised Senate, it will be much more difficult for Biden to get bipartisan support to make any radical changes in regulations, tax reforms or even to get a larger fiscal stimulus package signed off.

Mr Schinkel said: “With Trump losing the election, the Republican Party is becoming a different party, but the setup is still the same. You will be taking away the unpredictability of Trump, but if the Republicans are still in control of the Senate, not that much changes.”

Mr Schinkel said: “Currently, the market is expecting the Democrats to have less than a 30% chance of winning majority in the senate.”

Volatility could continue, with a weaker US dollar likely in the long term

In either case, the long-term outlook is for the US dollar to remain under pressure. The Federal Reserve has opened the door to loose monetary policy, with a low-for-longer approach to interest rates which hints at limited growth. Other economic fundamentals such as unemployment levels will continue to put downward pressure on the US dollar in the long term, even though we are likely to see a lot of volatility in the meantime.

How to prepare

Just as polling doesn’t always foretell how an election will play out, currency markets can be hard to predict. There are many unpredictable factors at play for the global economy over the coming months, including Trump’s remaining time in office, the transfer of power between administrations, Brexit, and of course the COVID-19 pandemic.

With volatility never out of the question, it makes sense to consider your global money transfer needs and goals, and to be prepared. That way, when currency swings present opportunity, or you need to act quickly to defend against rates moving against you, you will feel confident and in control. Because when it comes to your money, informed decisions are the best decisions.

Whether you’re waiting for the right exchange rate, or just need a little support with the transfer process, our OFXpert team is here to help 24/7. Contact us today.

______

1https://www.nytimes.com/2020/11/06/us/politics/trump-election-voter-fraud.html

2https://abcnews.go.com/Politics/inside-trump-campaign-grapples-defeat-plowing-forward-legal/story?id=74082317

3https://edition.cnn.com/2020/11/07/americas/biden-global-reaction-election-intl/index.html

4https://abcnews.go.com/US/number-covid-19-infections-reaches-daily-record-us/story?id=74090045

5https://www.nbcnews.com/politics/2020-election/clinching-victory-president-elect-biden-declares-time-heal-america-n1247013

6bbc.com/news/election-us-2020-54866037

7https://www.ft.com/content/5ce99af6-e776-43af-9c74-593d49dc5125

Download the OFX Currency Outlook

Learn more in the latest edition of the OFX Currency Outlook. It’s been produced to help you navigate market movements today, and to understand what to watch out for in the coming months.