Transfer money internationally

Excellent rates and no capped amounts. Transfer today.

An offer so good you’ll have to try us

New to OFX? Take advantage of a great introductory rate across 7 currencies (GBP, EUR, USD, AUD, NZD, CAD) on your first personal transfer. Terms and Conditions apply.

Terms and Conditions: The introductory rate is available to: (i) new personal customers who register under UKForex when making their first transfer; and (ii) UK personal customers who have registered from 1 April 2021, and have not dealt. The introductory rate is for first spot transfers only and not for subsequent transfers. Eligible sell and buy currencies include GBP, EUR, USD, AUD, NZD, CAD, SGD. Offer not available in conjunction with any other offers or to customers on a pre-arranged fixed customer rate. OFX reserves the right to withdraw the offer at any time. All transactions are governed by OFX Terms and Conditions which includes information in relation to Margin which is how we make our money.

What our customers say

Save on the rates banks charge with OFX

Want to keep more of your money?

Unlock bank-beating rates for global money transfers with OFX. We make moving money easy and help you access real savings.

Need to talk? When it comes to your money, we understand that sometimes you need reassurance that everything’s on track. That’s why you can talk to one of our currency specialists on the phone 24/7, day and night.

Real help when you need it and a simple, streamlined digital platform when you don’t.

Register for free and try OFX.

Transfer amount $GBP 20,000 to EUR

| Company | £10k GBP to EUR = | € difference |

|---|---|---|

| €11,521 | €221 extra | |

| Lloyds Bank | €11,300 | €221 less |

| HSBC | €11,351 | €170 less |

| Barclays Bank | €11,396 | €125 less |

| Natwest | €11,443 | €78 less |

The comparison savings are based on a single transfer of GBP£10,000 to EUR. Savings are calculated by comparing the exchange rate including margins and fees provided by each bank and OFX on the same day (1 October 2024). Pricing data is provided by an independent third party, FXC Intelligence Ltd. The comparison savings provided is true only for the example given and may not include all fees and charges. Different currency exchange amounts, currency types, dates, times and other individual factors will result in different comparison savings. These results therefore may not be indicative of actual savings and should be used only as a guide. The rate comparison chart is updated monthly.

Ready to send money? You could be up and running in minutes

1. Open an account

Complete the registration

form in just 5 minutes

2. Send the funds

Enter your recipient’s details

and send OFX the money

by bank transfer

3. Track the transfer

Track your transfer online

or via our OFX app

Need to talk to an OFXpert?

With offices around the world, our business day follows the sun. You can always speak to us, day and night.

Why choose OFX

- Bank-beating rates: Keep more of your money as it travels around the world

- 50+ currencies: Make transfers to over 170 countries

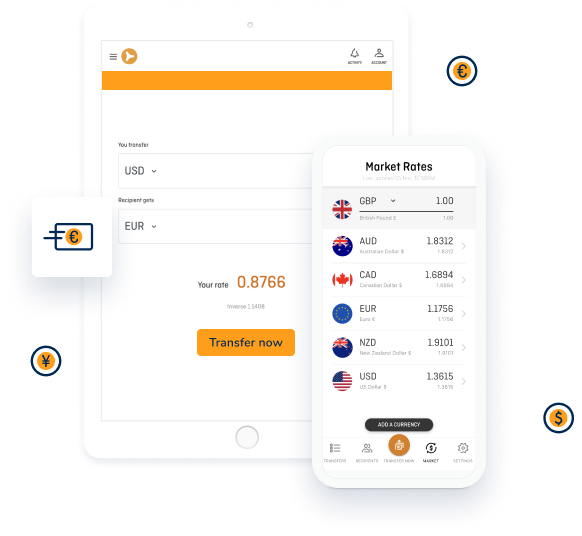

- Easy to use: Check rates, make payments or track transfers online or via our app

- Peace of mind: OFX is ASX-listed and monitored by over 50 regulators globally

- We know FX: Markets can move, we can help you plan for ups or downs

- 24/7 support: Talk to a real person at any time, day or night