Conquer international money transfers with ease using OFX. Navigating fees, exchange rates, and platforms can feel overwhelming if you’re sending money across borders for the first time. With OFX, it doesn’t have to be. This guide unlocks the secrets of foreign exchange (FX) so you have the key to making international transfers with confidence, ease, and great rates.

Master your first transfer step-by-step with OFX.

Setting up your account: Your OFX international money transfer guide

When you’re ready to make your first international money transfer, we’re here to help. Follow the steps below to get started.

Whether you already have an OFX account or you are looking to create one, the first step is to gain access to the OFX platform. Both the login and registration buttons can be found at the top right of every page on ofx.com. If you need to register simply follow the link to set up your OFX account here. Otherwise login to your OFX account.

- Verify your identity

Making sure your account is secure is our top priority. To open your account you’ll need to get verified. This involves providing some form of ID, such as a passport or driver’s licence, and proof of address. One of our OFXperts will also be in touch to verify your details. During this call or via a hyperlink, our team may request additional information, which can vary for personal and business accounts, but we aim to make it quick and easy. You’ll get a confirmation email once your account is ready to go.

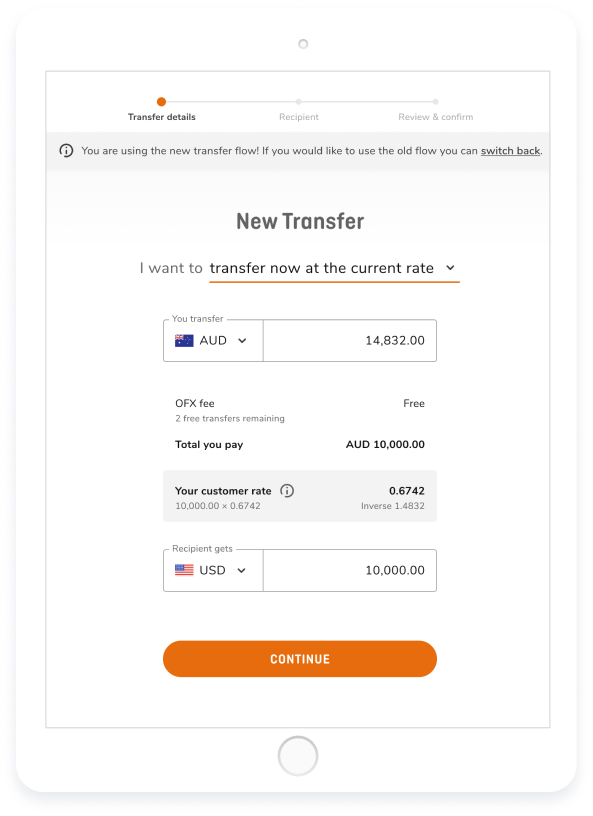

- Get a quote

After logging in, confirm the currencies and the transfer amount.

Our simple platform will show you the current OFX customer rate and the amount your recipient will receive. If you’re happy with the rate, you will be prompted to the next step to ‘Add your recipient’.

Begin making your first transfer with OFX by getting a quote so you know your exact customer exchange rate.

Ready to start transferring with OFX? Register now

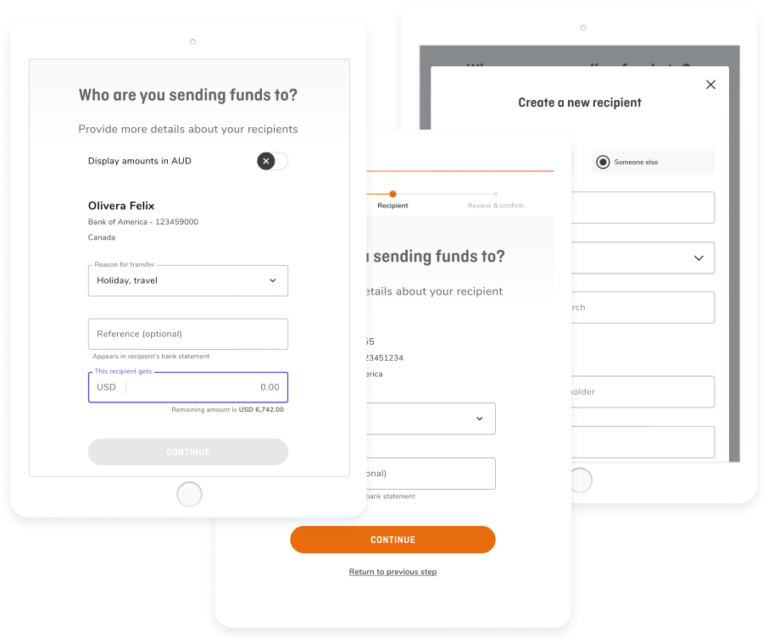

- Add a recipient

Enter your recipient’s banking information, including details like the country the account is in, account currency, name on the account, and bank address. Details may vary based on currency and location. Once you’ve entered and reviewed the details, your recipient is automatically saved for future use. If you have any problems, contact our OFXperts who can help – they’re familiar with hundreds of account types so we can always help you navigate your first transfer, your second, or your one-hundredth.

Add recipient details via your OFX online platform once and they will be saved for future use.

- Link your funds

After adding your recipient, you can make your first transfer with OFX by linking your bank account to the OFX platform. Just fill out your banking information for the account you’re transferring from, similar to when you added your recipient’s details. Details may vary based on the currency and location you are transferring to. It is also possible to supply funds by sending OFX a payment. Contact your OFXpert for more details.

- Select the timing of your transfer

Once you have entered your recipient, select your transfer timing: transfer right away at the current rate of exchange (Spot transfer), set a target rate for this transfer (Limit order), or lock in the current rate of exchange but complete your transfer at a later date (Forward Contract)*. If you are interested in locking in a rate you will need to call your OFXpert before your first transfer.

*Forward Contracts are not available for personal clients in Hong Kong.

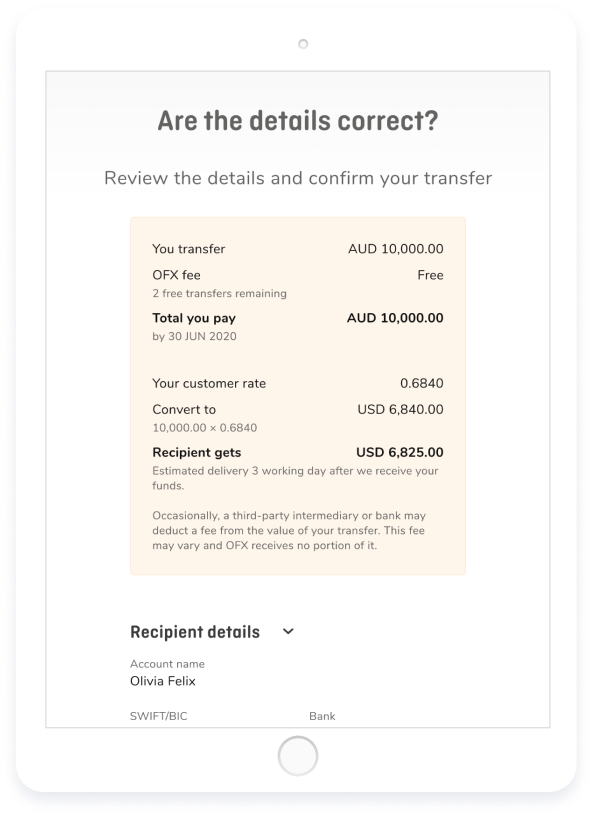

- Review and confirm

Next step is adding a ‘Reference’ for this transfer. This is the reason for your transfer such as “goods purchase payment” or “European vendor payment”, which will be visible on the recipient’s bank account statement. Then select ‘Review & Confirm’ for a final check of your intended transfer. If you’re happy with everything, hit ‘Confirm’ and you’re done! OFX manages the rest.

Once you’re ready to make a transfer, review the details and confirm everything is accurate so we can get your money moving.

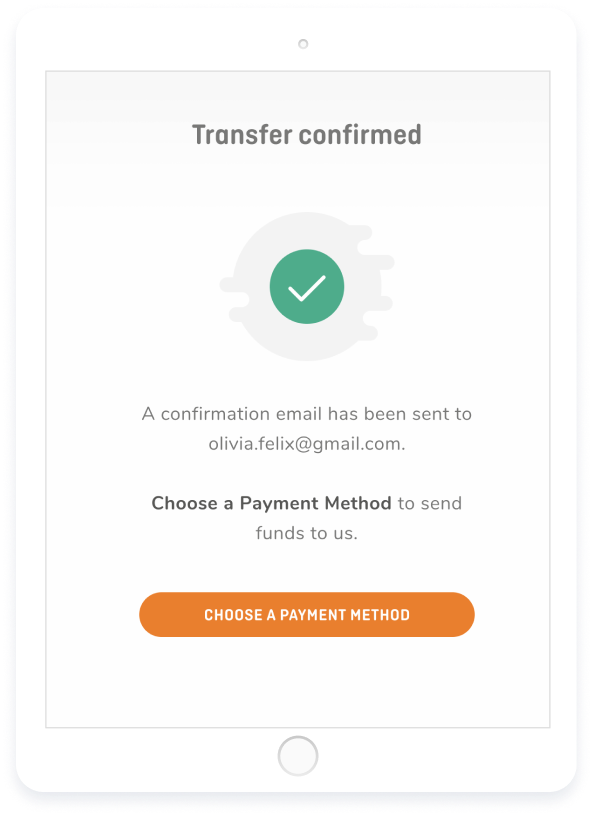

- Wait to hear from us

An OFXpert will call you shortly after booking a personal transfer that falls under any of the following categories:

- You are sending your first personal transfer with OFX

- You are sending funds to a new recipient

- You are transferring exotic currencies

- You are sending more than $100,000

This precaution is to ensure that your money is secure when transferring with OFX. If your FX trade falls under any of these categories please make sure your contact details are up-to-date and your phone is nearby. If you are transferring from a business account and the transfer does not fall into the above categories, your OFXpert will review your pending deals and assess whether a confirmation call or email is needed based on past account history. Otherwise, after you hit confirm you will receive a deal confirmation email to ensure that your transfer was processed.

Finally, just wait to hear from us. OFX will send you a confirmation email to ensure your transfer request is received.

Money transfers made simple with OFX

Now that we’ve covered the steps to completing your first transfer with OFX let’s run through some of the differentiators that keep our clients transferring with us:

- 24/7 customer service: Call us anywhere, anytime and our OFXperts will be ready to support all your FX needs. Our clients love the customer service OFX offers and the reliability of our FX experts (we call them OFXperts). “I think the best thing about working with OFX is definitely the problem-solving and attention to my transfers. Tsewang, my OFXpert, stays on top of my transfers. He always knows where they are at and keeps me updated.” – Todd, OFX client

- User-friendly platform: Our online platform is easy to use and great for clients on the go. For personal money transfers, use the OFX app, to make secure transfers anywhere, anytime.

- FX industry experience: With over 25 years in the FX industry, and listed on the ASX, OFX has earned the trust of over 1 million clients with transfers in 50+ currencies to over 170 countries. “Everyone wants to work with suppliers who trust you. That was one of the biggest differences I saw when I began working with OFX. When people see a copy of a transfer that I sent and see that it’s through OFX they know it is a reputable company and they trust that it will come through.” – Marina, OFX client

- Competitive rates: We provide a fairer way to move your money, offering competitive rates through a global network across 115 bank accounts.

Ready to open an OFX account to send and receive payments? Make your first transfer with OFX today.

If you’re looking to open a personal account, enjoy extra savings on your first personal FX transfer with our introductory offer.

Transferring money is simple with OFX

Follow our step-by-step guide to initiate your first transfer with OFX today.

Chat with a real OFXpert! With our 24/7 customer service availability and an open line of communication, we can help your business go global. Contact us today.

IMPORTANT: The contents of this blog do not constitute financial advice and are provided for general information purposes only without taking into account the investment objectives, financial situation and particular needs of any particular person. UKForex Limited (trading as “OFX”) and its affiliates make no recommendation as to the merits of any financial strategy or product referred to in the blog. OFX makes no warranty, express or implied, concerning the suitability, completeness, quality or exactness of the information and models provided in this blog.