Transfer money online now or save time and money on future transfers

Global money transfers made easy

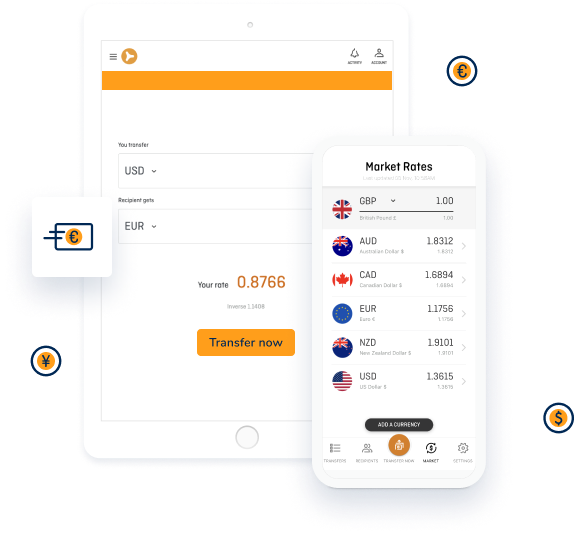

- Send money from A to B fast in 50+ currencies

- Save money with OFX’s great rates

- Transfer online, in-app or over the phone

- Products to plan ahead for future transfers

Need help creating your account?

Want to ask a question?

You can call or email us, anytime. With offices in 9 countries, there’s always an OFXpert to help you, 24/7.

Send money to over 170 countries

Quick, secure, global payments to more than 50 currencies

Ready to move money? Do it simply, securely, and at a great rate.

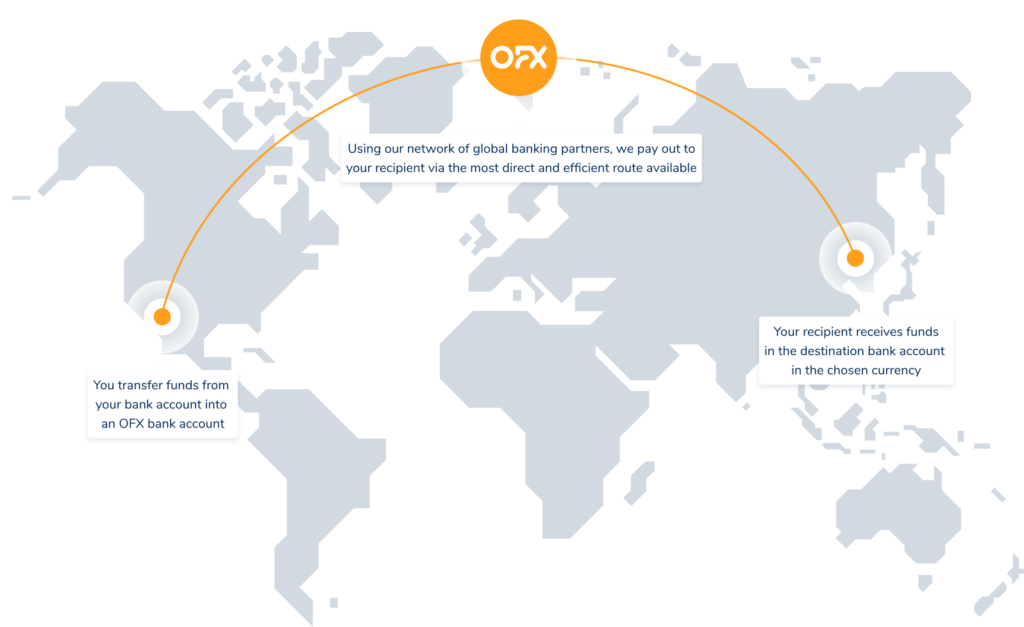

How it works

Other topics you might be interested in

General FAQs

A Forward Contract is an arrangement that allows you to transfer money at some time (up to 12 months) in the future at an exchange rate that you agree to now, so that you know what the exchange rate will be at the time the transaction takes place. This allows you to avoid the risks and uncertainties associated with adverse exchange rate movements.

Forward contract: Benefits

A Forward Contract may be beneficial for businesses and individuals if exchange rates are particularly attractive now, and you want to lock in that rate to hedge against uncertainty in the future. This can be especially helpful for small businesses who want to keep their cash flows predictable when buying or selling overseas.

Forward contract: Elements to consider

Entering into a Forward Contract is a binding arrangement. Therefore, a Forward Contract may preclude you from taking advantage of exchange rate movements of your currency pair if the exchange rate moves in your favour. To continue to take advantage of exchange rate movements, some customers use a Forward Contract for only part of their liability as a way to partially hedge against volatility.

You may be asked to pay a deposit at the time of booking a Forward Contract, or during the life of the Forward Contract (a “margin call”). No interest is paid on deposits.

Talk to one of our dedicated OFXperts today to develop a currency strategy that’s right for you.